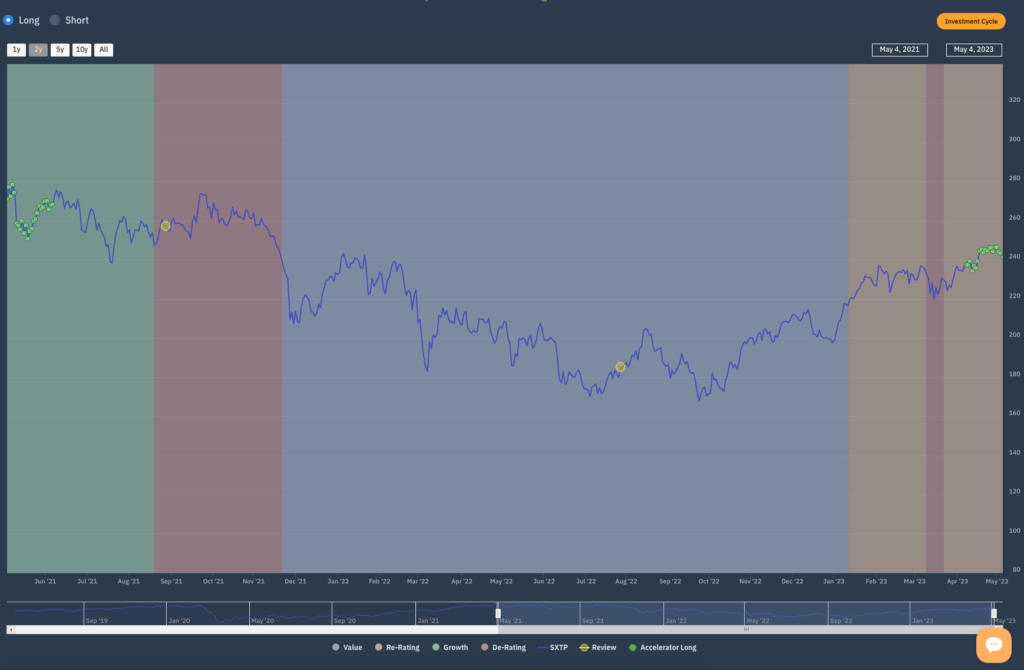

We have been highlighting the Travel sector for most of this year – in fact all but 10 days of it as a look at the image below of the Investment Cycle shows.

The sector entered the re-rating phase on January 10 and since then the good news has just kept coming. When Factor risk changes you need to know especially when accompanied by our idiosyncratic signals of momentum and volatility (Accelerator and Risk Adjusted return signals). This combination forms the basis of our Smart Alpha strategy and why it works as well as it does. For as long as the sector is re-rating and there is an Acc long signal you know you are in a good place and when it changes, the dynamics of the stock / sector / market change.

Stock level investment factors are frequently discussed in terms of the differentiated nature of the expected (investment) returns that can be attributed to them, but it is important to recognise that the determination of what “style” factor a stock is “driven by” is neither a fixed, static process nor simply a function of an external macroeconomic cycle. Macro considerations obviously play their part, but..

evidence suggests that stocks migrate from one factor category to another over time in response to changes in their own underlying fundamental outlooks and in the collective risk appetite of the market towards those changing levels in stock-specific expected returns.

In other words, the investment risk factors that we might consider systematic for each stock – value, growth, quality, junk – are not discrete, persistent factors but are factors that can be treated as phase components of a broader market risk appetite cycle towards the stock in question that, when combined with the stock level forecast expected return, provide the drivers of the share price in question