On April 14 we made a comment on European Banks – ‘Risky Business’ . This piece touched on the 3 stages of investment. From the moment one takes the decision to buy, realising that on balance the shares are at their lowest point and pricing in appropriate risk (Act 1) to the moment, the shares recover ‘back to value’ (Act 2) and then on to Act 3. Is that the end or is the start of a new beginning?

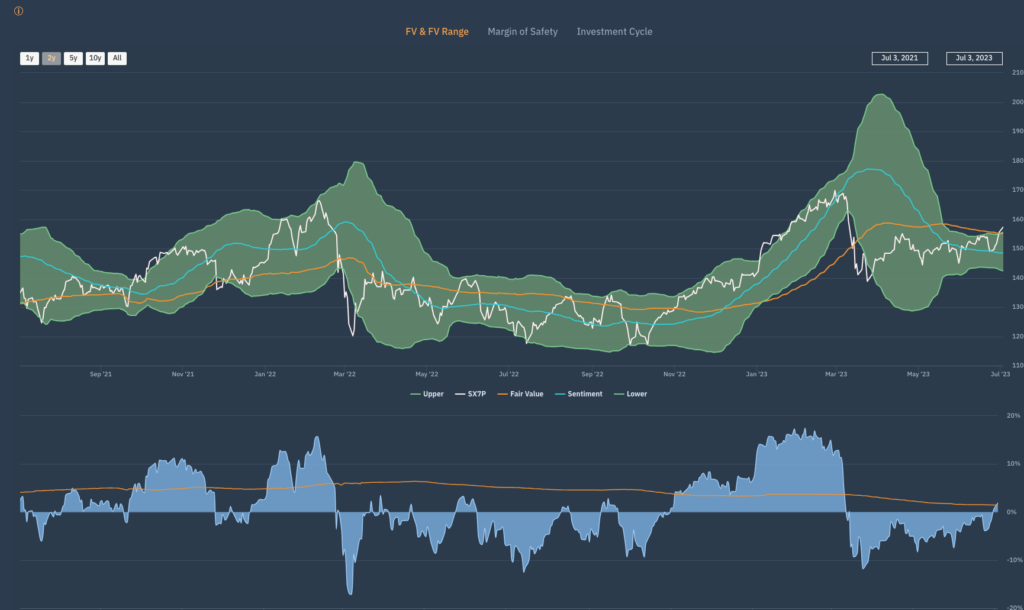

Since we ‘called the bottom’ for the sector as you can see from the blog comment on April 14 and the Apollo Margin of Safety chart, the SX7P has rallied from €140 to €157 (12%) but as of today, the sector has not only come back to value (the Apollo FV for the sector is €157.35) but broken above that level and the upper boundary of the FV range.

All of this suggests that we should be more positive and involved in the sector.

Although in the Value stage of the Investment Cycle is clearly enjoying a change in sentiment as the ICC being priced in by investors has started to fall with the appropriate price response. Would be like to see the Re-rating cycle begin? We would but the Accelerator / Momentum long signal has appeared which tells its own positive story. Banks are back in the menu.