- Constructing a successful investment portfolio requires not only a consistent measure of current values and forecast expected returns across the investible universe but also a clear understanding of what are the causal drivers of these expected return factors. At Libra we offer clients access to this proprietary content via the Apollo EDGE platform but we have also created our own Smart Alpha Strategy which is also available on request.

- What causes the market to apply a particular risk premium to a future payoff is not just a matter of stock specific risk: systematic (macro related) risks are dynamic, causal influences that also need to be considered

- Stock level sensitivity to both internal and external shocks will vary over time and portfolio construction needs to consider the differing ways in which a change in macro or micro conditions might impact both individual stock returns and the portfolio in general. The Apollo Investment risk cycle.

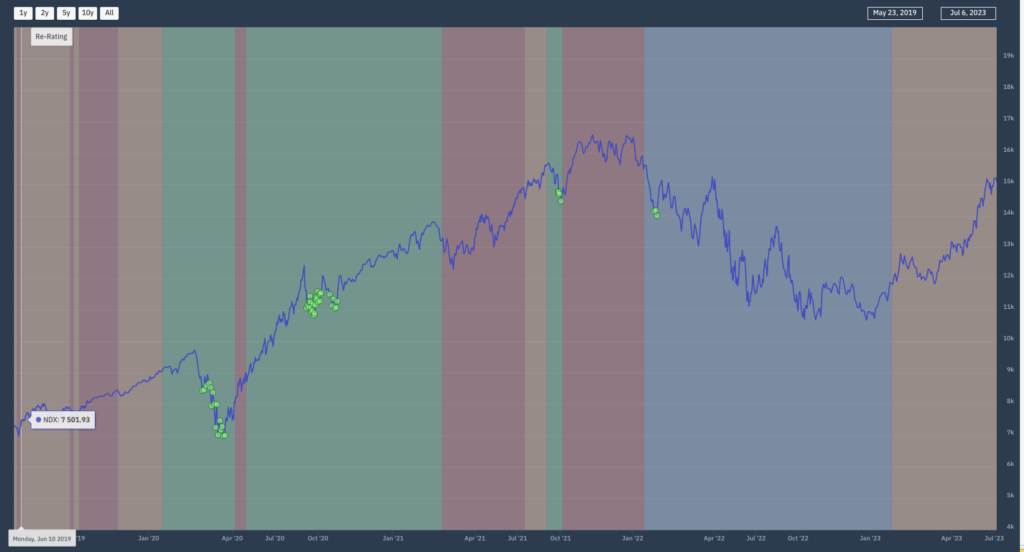

Empirical analysis is able to show how this takes place via the transmission mechanism of the investment cycle (see image of Nasdaq 100). This dynamic proprietary investment risk cycle shows stocks move through periods of Value, Re-rating, Growth and De-rating thus creating factor buckets at a single stock level conditional on whether a stock’s ICC is falling, rising, peaking or troughing. – from the bottom up.

Understanding the normalised position within the Investment Cycle – Value, Re-rating, Growth and De-rating is a vital piece of the investment process and improved returns.