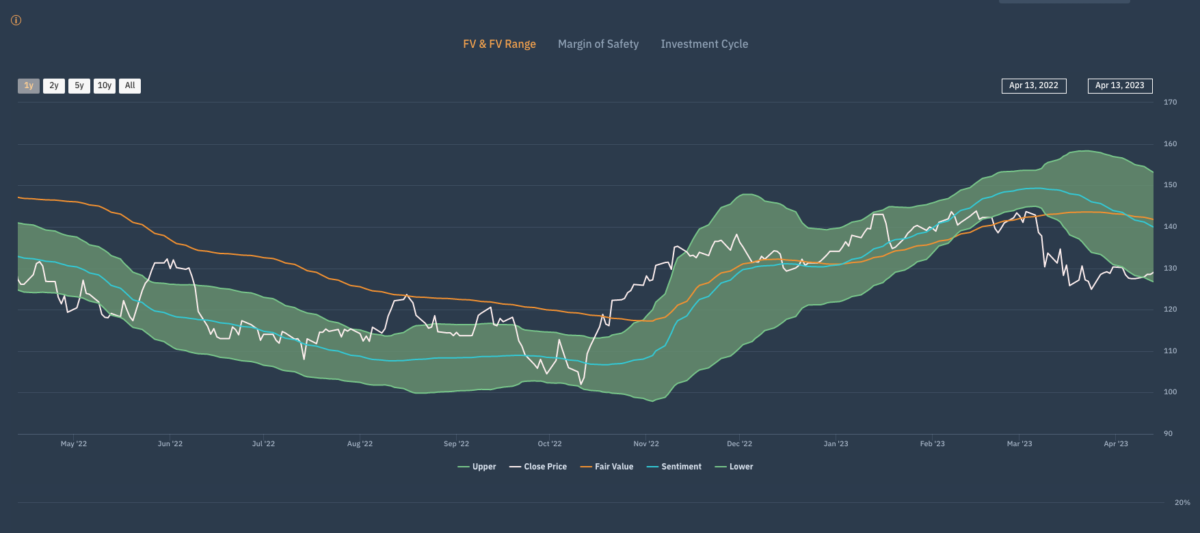

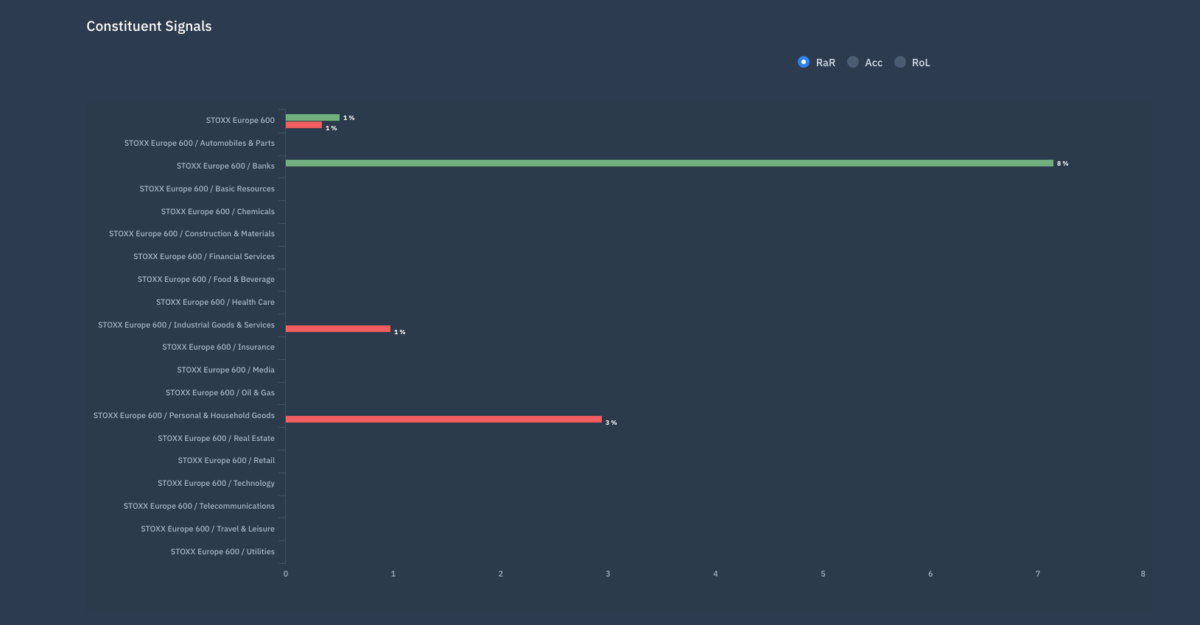

The story of this sector has been one that demonstrates perfectly the Apollo Investment Cycle as we have seen the move from Value to Re-rating and Growth. We now have a group of low volatility Re-rating and Growth stocks – otherwise known as Quality and as we look at the group today we see the majority showing Accelerator Long signals to fully support the investment case that investors have been buying into.

Categories

Hitting The Target