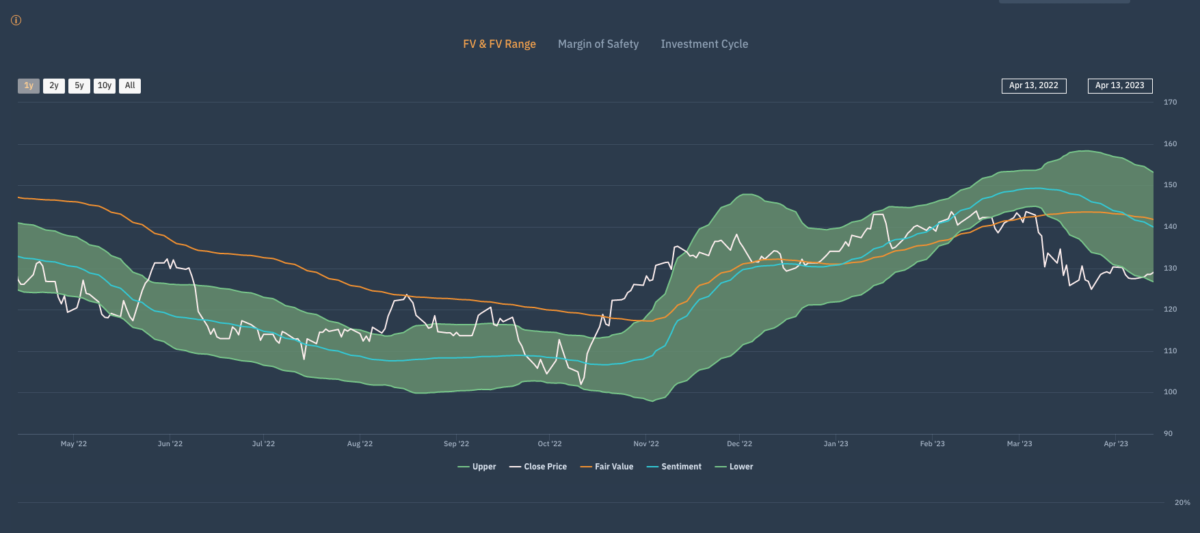

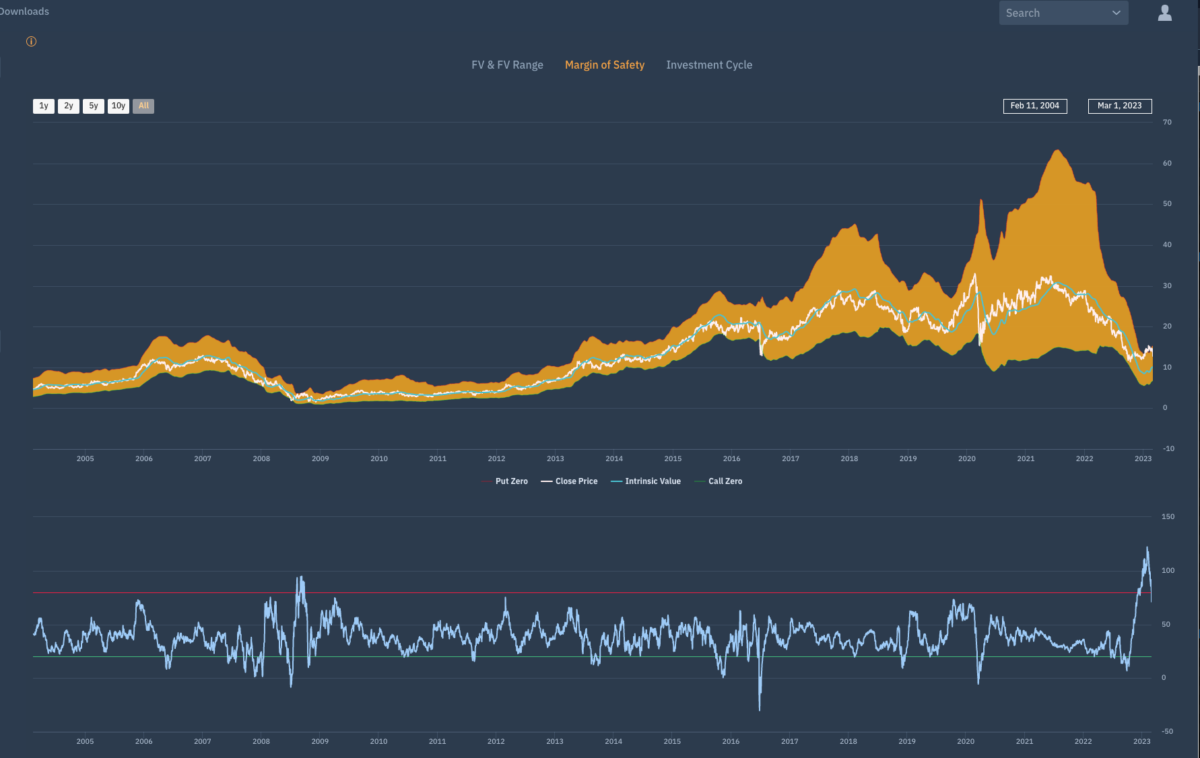

Since we ‘called the bottom’ for the sector as you can see from the blog comment on April 14 and the Apollo Margin of Safety chart, the SX7P has rallied from €140 to €157 (12%) but as of today, the sector has not only come back to value (the Apollo FV for the sector is €157.35) but broken above that level and the upper boundary of the FV range.