There are many reasons why our Smart Alpha process works so well and stands up to scrutiny.

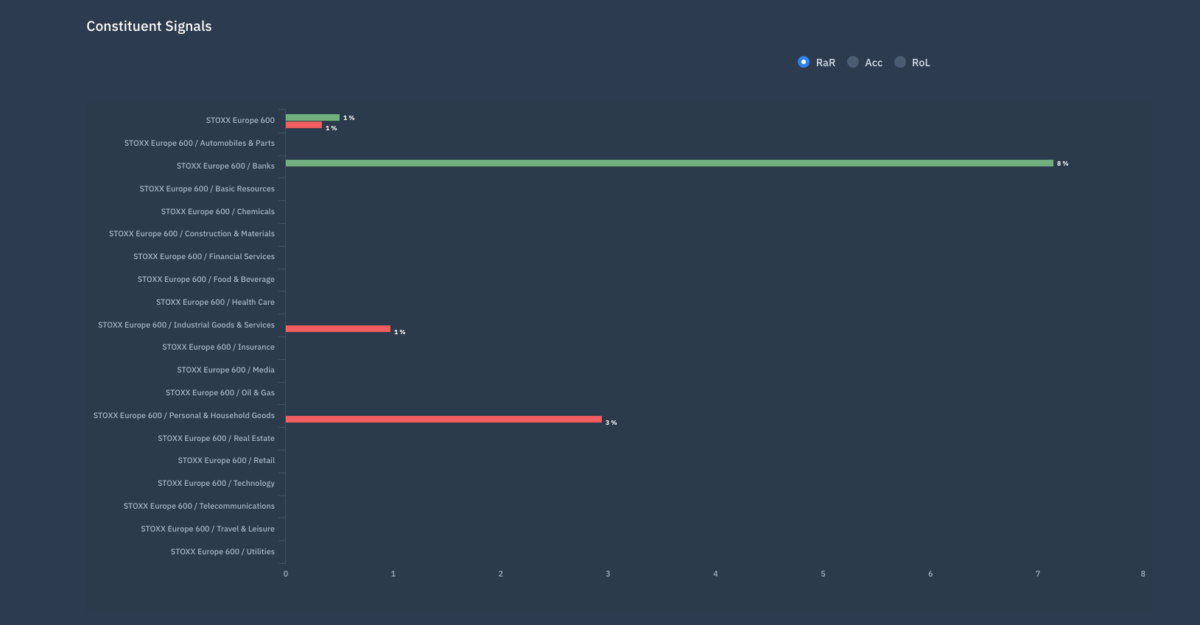

We start with the investible universe and immediately ‘knock out’ the stocks we don’t want to own. Stocks are initially selected by Factor – a ‘bottom up’ selection process.