Welcome to the Weather Forecast

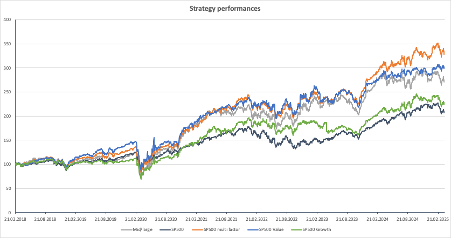

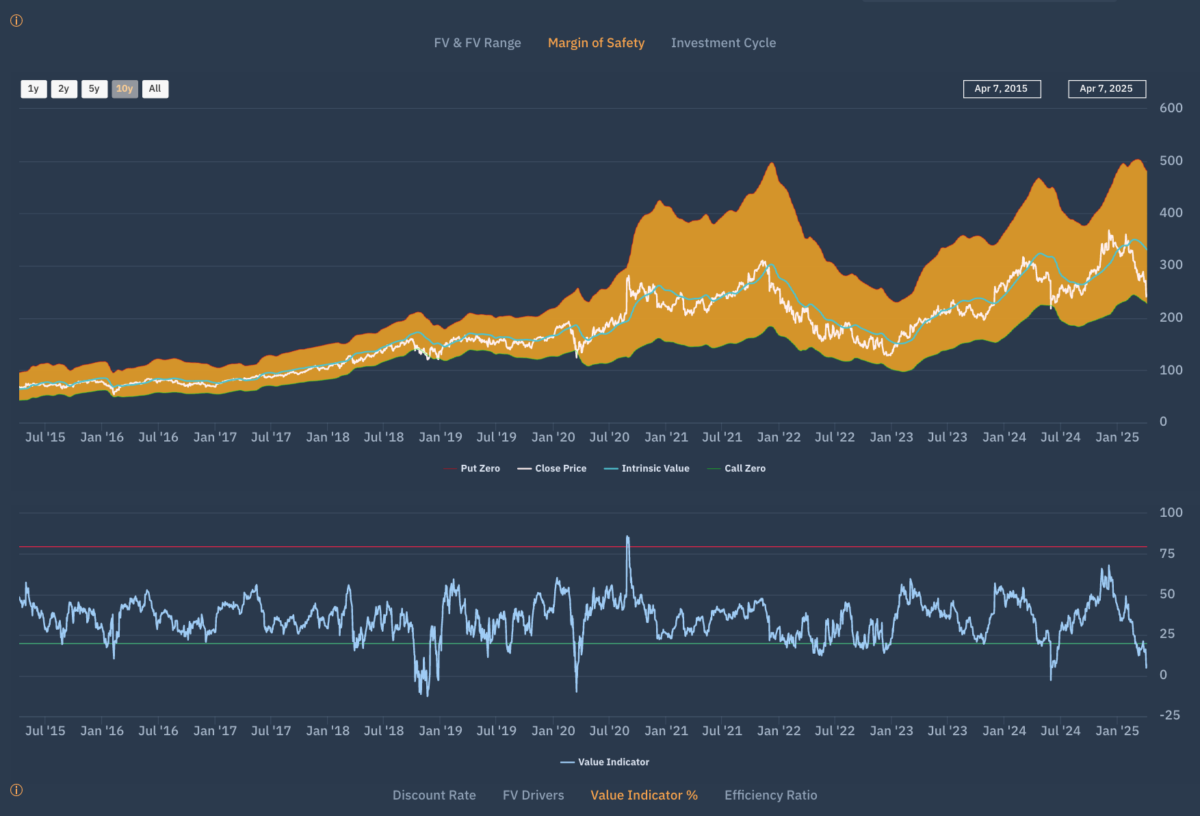

As we continue to roll out our Smart Alpha strategies, we are publishing a regular newsletter – the Weather forecast that looks at how Smart Alpha strategies can help navigate the current investment climate.

The Weather Forecast : Q2 2025