It took a war but once Russia invaded Ukraine, investors turned their focus on the Global Aerospace and Defence sector. Initially, as ever we saw share prices spike before analyst recommendations or expectations changed and for a moment, share prices fully discounted top end expectations. It was no surprise to see RED Risk Adjusted return and high Risk of Loss warning signals as seen in the chart below in February 2022.

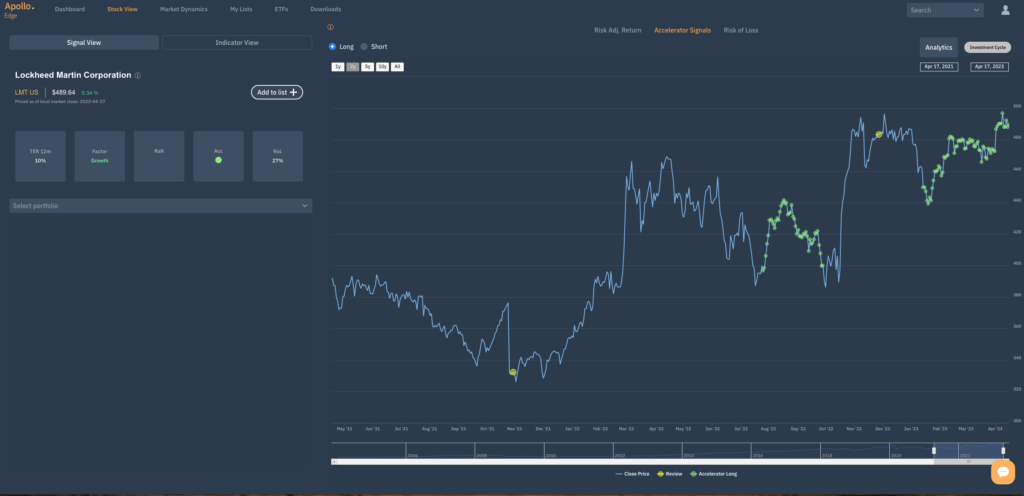

What followed was a period of price consolidation as investors waited for Government’s responses and analyst upgrades to come through, at which point we started to see our Accelerator Long signals kicking in (see the chart below of Lockheed Martin) – investors were anticipating an acceleration in the expected return – a change in the momentum of the expected returns. A sure and positive sign of market optimism.

Markets being what markets are, there have been periods of profit taking on the one hand and other periods when the market has been left behind as expected returns have continued to improve at which point we started to see Value signals appear – positive Risk Adjusted Signals or even positive Risk of loss signals (see the green dots in the top chart of BAE Systems.

The story of this sector has been one that demonstrates perfectly the Apollo Investment Cycle as we have seen the move from Value to Re-rating and Growth. We now have a group of low volatility Re-rating and Growth stocks – otherwise known as Quality and as we look at the group today we see the majority showing Accelerator Long signals to fully support the investment case that investors have been buying into.