Immediately after the recent drama within the Banking sector, triggered by SVB and Credit Suisse we posted a comment titled “Gimme Credit” which highlighted the extent to which the market priced in extremes of risk within a six month period for the bank sector as a whole and individual stocks by extension.

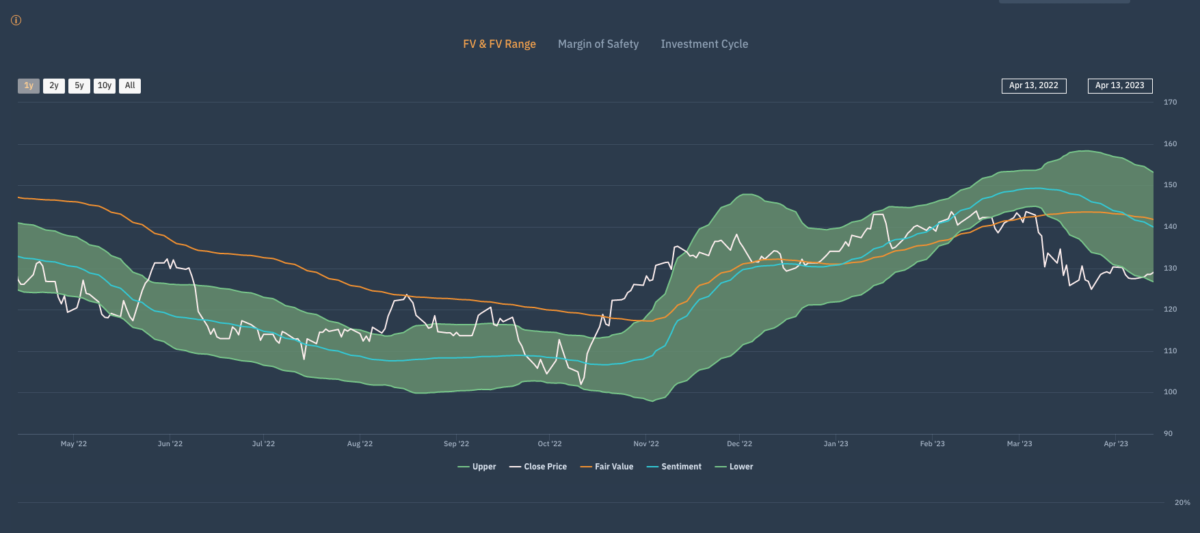

What we witnessed was the market re-rating the sector, taking it from trading at extreme discount to FV in October 2022, to trading at historically high premium in late February / March 2023 – an extraordinary re-rating to a point where red flags in the form of the Apollo Risk Adjusted Return signals were appearing. (Not easy to see on the chart below for JP Morgan but November and January are the relevant dates.)

The subsequent market over-reaction saw US and European bank share prices crash back through Fair Value levels (Asian banks remained relatively unaffected) to the extent that the Apollo Margin of Safety / low risk of loss signals were universally triggered – the green dots on the chart above – and as we look at share prices today as results come in from JP Morgan and its peers the importance of this signal becomes obvious.

So far we have seen Act 1 and Act 11 of this three part play and the next Act will be the final part of this particular drama. At this stage there are already visible clues as to what happens next. The Apollo FV range has ‘blown out’ which is significant because the width of the range is an Apollo representation of the market’s perception of quality and evidently the risk in holding banks within portfolios will need to be re-assessed.

What we now see is the FV range and FV itself starting to roll over and we should now surmise that share prices can once again go back to value (FV) at which point investors will need to make another decision because history suggests that share prices will not break through that value barrier until confidence in the expected returns…returns.