The recent ‘Banking Crisis’ was the excuse the Bears needed to come out of their lairs and appear (and be asked to appear) on the news wires and tell us that within this context the S&P 500 trades on a PE of 20x – the market has run out of road. With inflation remaining the other talking point -up or down- and the upcoming earnings season around the corner, there is plenty to think about, particularly because the Banks kick off that reporting season.

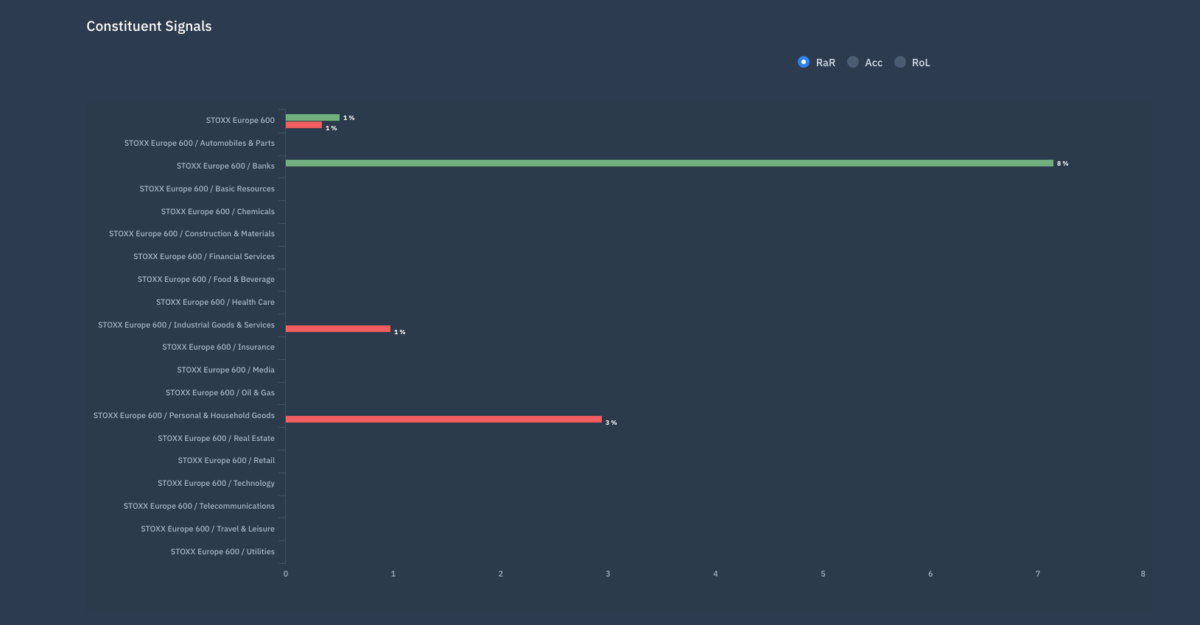

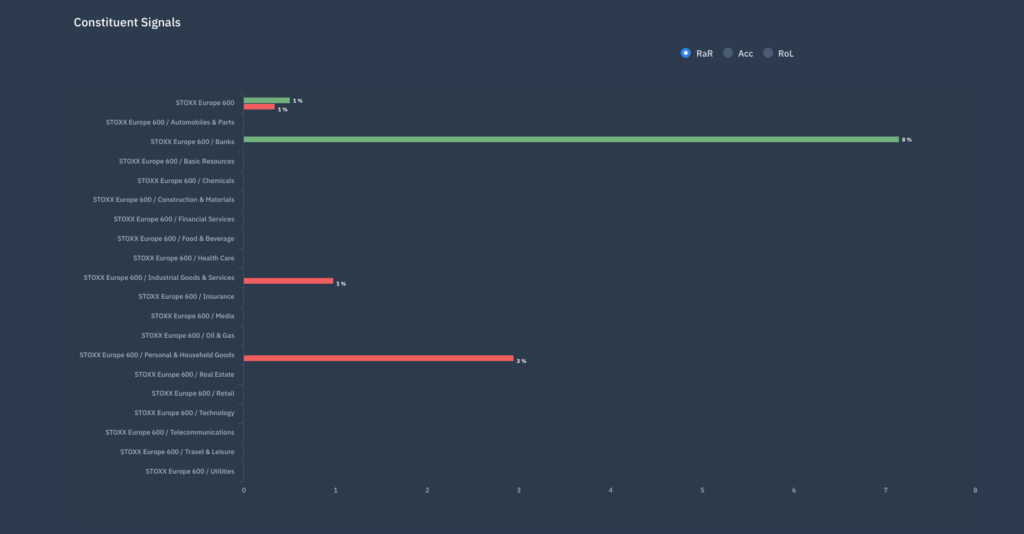

Naturally, we find the Apollo signals and indicators shine a light on opportunity and risk. The latest signals to appear have been Value within the Bank sector and for good reason. If we look at the low Risk of Loss signal and positive Risk Adjusted Return signals, the sector dominates and if one has a positive view of the outlook as Crispin Odey might, this is your time.

Outside of Banks the clues at a stock, sector and market level are few and far between. Both the S&P 500 and Stoxx 600 are no longer in the re-rating phase of the Apollo investment cycle and that points to more volatile times and as a consequence many sectors have transitioned from Re-rating to De-rating or Value. Investors have begun to re-consider the outlook of earnings, cash flow, sales, book value and EBITDA. Stock prices don’t reflect this…as yet.

So as markets seem to serenely move along it’s worth knowing that at this stage and until further notice the trend is you friend because Value and Growth signals remain few and far between.

The only problem with following the trend (and here we are talking about the trend in value as investors re-rate stocks / lower the Implied Cost of Capital) is that any bumps in the road that provoke investors to re-thing those assumptions might see a quick and negative price response.

Keep looking for clues.