A series of individual stock concerns in both the US and Europe – think Glaxo Smith Kline, Moderna, Astra Zeneca, Eli Lilly, Smith and Nephew, Merck and even Novo Norsdisk added to the fact that the new Trump administration may not be friendly for the sector has seen the sector in a Trump Slump.

As bad as US healthcare has performer, Europe has done worse. The old adages of not standing in front of a moving train or not trying to pick the bottom are at the front of minds when markets, sectors or stocks trade in oversold territory but with the sector on its virtual death bed there are indications on Apollo that relative to history at least, we could well be at or very close to a recovery.

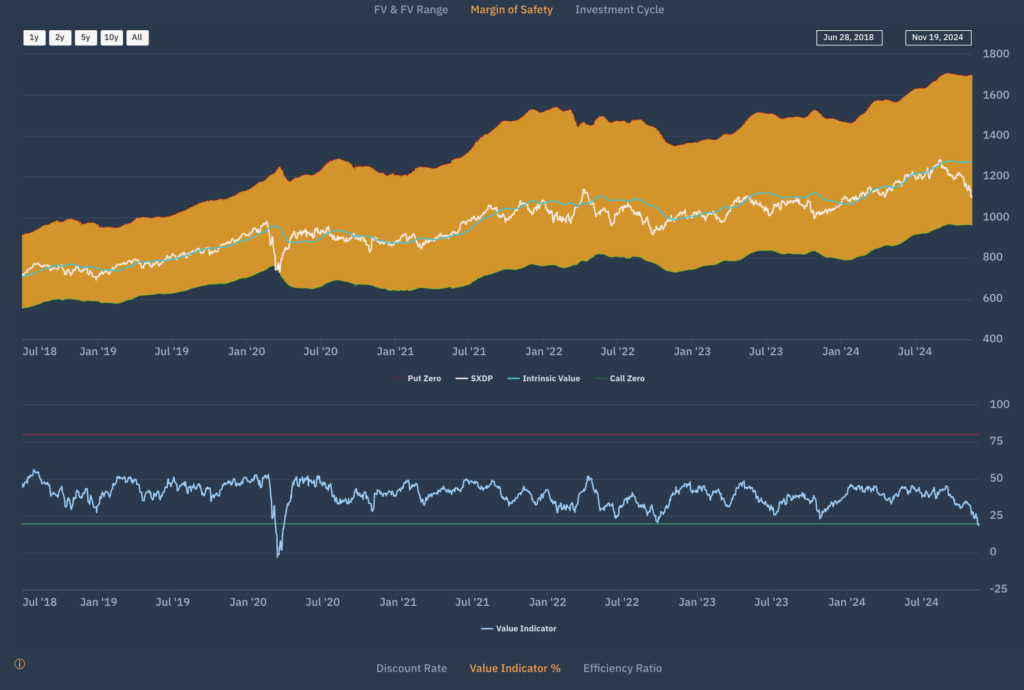

One chart in particular is worth looking at – the Margin of Safety in conjunction with the Value Indicator score (represents a stock’s percentile position within the Margin of Safety range.

The Margin of Safety indicator applies a real options pricing model to determine the Margin of Safety demanded by a marginal investor in a stock (more on request.) You see the relationship between the price and future value over time and as the chart below shows, on this basis the current price of the sector is at a historic low. This would naturally lead us to suggest covering shorts or buying the sector.