It’s been some time since I posted content from our Apollo EDGE platform but to those that follow our work, the Investment Cycle and Implied cost of capital model are key to understanding when stocks enter periods of change.

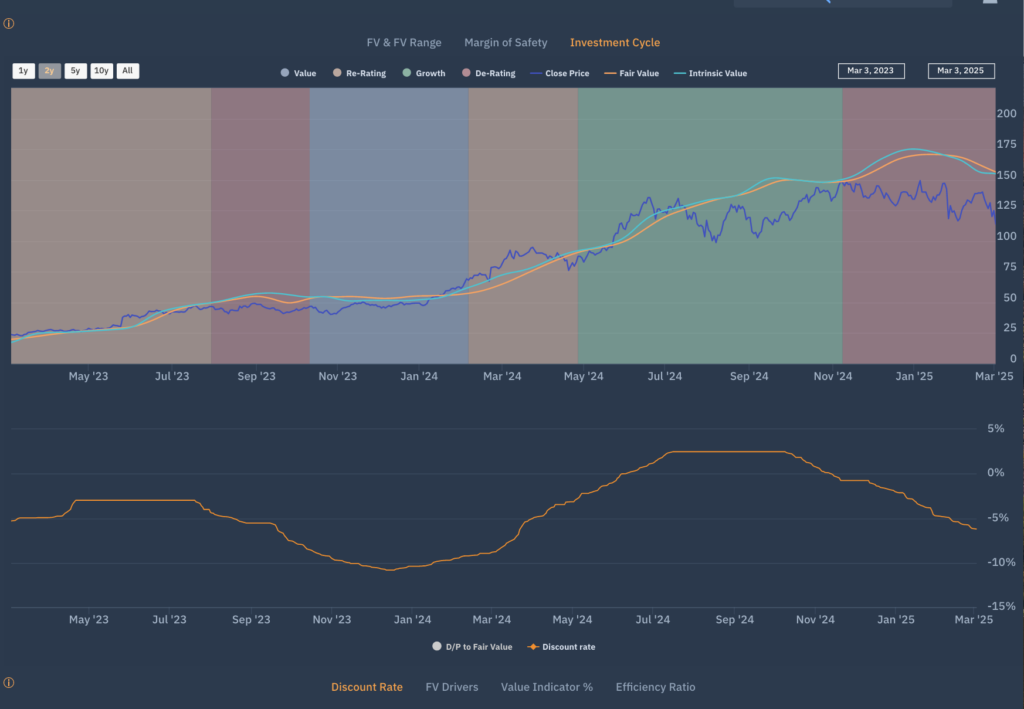

In the images below you can see the Investment Cycle evolution over time. Nvidia entered a de-rating cycle in early November. The de-rating accompanied that change. What we are seeing with Nvidia (and one could have seen this in real time) happened with Tesla before it and many stocks before that.

It’s not that share prices can’t have periods of time when they go up when a stock is undergoing a period of De-rating, as Nvidia is now undergoing, as happened when Trump was elected, but when investor appetite for risk and perceptions of future cash flows change they tend to change for extended periods of time.

Nvidia is a different investment story now that it’s been for a long time and needs to be seen and traded as such. It should be bought when the degree of risk is fully priced in or when the investment cycle moves into a period of re-rating once again. The Apollo signals and indicators do just that.

It’s all about the use of data, but you have to have that in the first place or find it from someone else who does.