Yesterday was a good day for the US equity investor. For the first time since the end of February, the S&P500 US large Cap price index was back in the green for 2025 – up 0.5% YTD. (Strictly speaking, the Total Return Index (price plus reinvested including dividends) achieved that landmark on Wednesday and is now up 1% YTD, but this is still (-3.4%) below its 2025 highs.) A (+19%) recovery from the lows of April 8th (+9.75% over the last month) for the total Return Index has offset the market fallout that followed “Liberation Day” and, in some ways, the “…what was that all about?” approach that we discussed in last week’s Weather Report continues to shape the current market narrative.

Something and nothing?

Headlines that applaud those who held their nerve through recent turbulence and rejoice in the “most hated melt up” for traders whose recent short positions on the market have now generated large losses, seek to give the impression that this was all about something and nothing. That the stampede towards the exits as the Media and Wall Street “Experts” shouted, “Tariff FIRE!!!” in a crowded Theatre was an irrational response to events and that every partial reversal of those fears now justifies those of sound mind and steely nerves (or perhaps those supposed “insiders’ who made a fortune buying at the lows) who remained committed to the market.

Much of this comes down to the perception that, in the long run ,markets only ever go up and so you can always “buy the dip” and “get in” at a better price. However, for many people, the perception of real loss of wealth in early April was palpable, and certainly significant enough to keep them up at night. Meanwhile, some of those who were using leverage in their “can’t lose” day-trading apps may have been looking for the proverbial high ledge to stand and contemplate from.

A sense of deep disquiet remains.

Even for the short-attention-span Tok-tok generation, it is hard to shake off the previous narrative of an over concentration in US equities, excessive exposure to the M7 (now back to November 2024 levels but still (-5% YTD) on an equal weight basis) the Deep Seek reality check for the AI story and the broader sense that back-to-back annual returns of 20%+ plus in both 2023 and 2024 for the S&P500 were an unrealistic norm. In fact, the rationalisations provided for the recent recovery/bounce in the markets look as unconvincing as those given on the way down and simply reinforce the principle of the market as a Casino – the you win some but you lose some idea that investment returns are not so much about considered decision making but luck… and that the House (i.e. not you) always wins.

Did I just “…put it all on red?”

It rather begs the question; “If this is “investing” for the future then shouldn’t I feel better about this whole process? Shouldn’t I be thinking how much better my future will be if I do this properly – and get this investing thing right – as opposed to feeling like I’ve potentially “put it all on Red” and screwed everything up and lost everything?” One could put it all in Govt bonds, of course, but that would only provide a negative real return on investment, compounding forward, so the opportunity cost of “sleeping well at night” could well be no longer having anywhere to sleep at all – 30 years down the line.

To answer the Investor’s dilemma, we need to be realistic about what “investing” requires of us. Investment managers seek to explain this Angst as an unavoidable consequence of the rewards provided by equity market returns – that the “…reward (return) comes a consequence of the risks that one must take to achieve it. This mantra -“…there is no return without risk” , the “buy the dip” and the “…you have to be in it to win it” mindset are part of the same message – the risk is on you (I’ll just take the fees thanks) but that it will (probably) all work out well in the end. From a practical standpoint, a more risk-balanced portfolio (a non-correlating mixture of Bonds and Equities) is the main proposed solution, but even here recent events have shown that Bonds and Equities have developed the nasty habit of becoming positively correlated in the face of market drawdowns; raising the question as to what risk is actually being mitigated by holding a position in bonds (“60/40” I’m looking at you) when yields are still negative in real terms.

It is not just about Asset Class exposure either. As individual investors, we need to make sure that whatever risks we are taking with our investments are properly understood and, where possible, mitigated as part of the overall process: good old “Risk AND Reward” in other words. This means that a portfolio of (in this example) Large Cap US equities needs to provide a balance of risk and return that doesn’t involve 50% of it being held in a handful of stocks that are all exposed to exactly the same kind of risk. Nor does it involve being fully exposed to the same kind of overall market risk that we see happening “relatively frequently” (every 3-5 years or so) when events like the recent selloff see the whole market move aggressively lower and then (hopefully?) bounce, with seemingly no ability to avoid the loss of sleep (and potentially wealth) that ensues.

The sad truth of the matter is that the investment products most investors have access to don’t provide this. Passive/tracker funds clearly don’t do any of the above but the “active fund manager is still very much on the backfoot. When benchmarked against an apparent “risk free” Index, the lack of annual outperformance (“…did you beat the market index in 2023 and 2024?”) for even a year can be disastrous so the temptation to hug the index or take risks with correlating assets (“Mag- 7 anyone?”) leads to a reinforcing group think.

All you need is alpha

Fortunately, (for those who have read this far), there IS a better solution. If I want to select a portfolio of Large-Cap US equities for my investment (something almost every investor already does by default), I can do so by selecting a risk diversified portfolio of around 50 stocks (~ 2% per stock) using a systematic value model and rebalance it frequently enough to make sure that, at any point in time I own enough of the right stocks at the right time stocks to give me good, repeatable, positive returns that beat the return of the overall market. Regular readers will be familiar with our approach to this, but you can go to our aide memoir for Smart Alpha here if you want to know more about our process.

Once invested in this portfolio I can then hedge this “Smart Alpha” portfolio against the risk that I am also taking – the US overall equity market (Beta) risk by Selling/going short the overall index in equal size against it. After all, there is no better hedge for market risk than the market itself and certainly not a portfolio of Bonds. Clearly this only works if one achieves a return higher than the market on a consistent basis – otherwise the return is zero even ahead of costs – but so long as this hedged “Smart Alpha” portfolio can provide a positive return that achieves a higher return than cash or Bonds, then you are good to go.

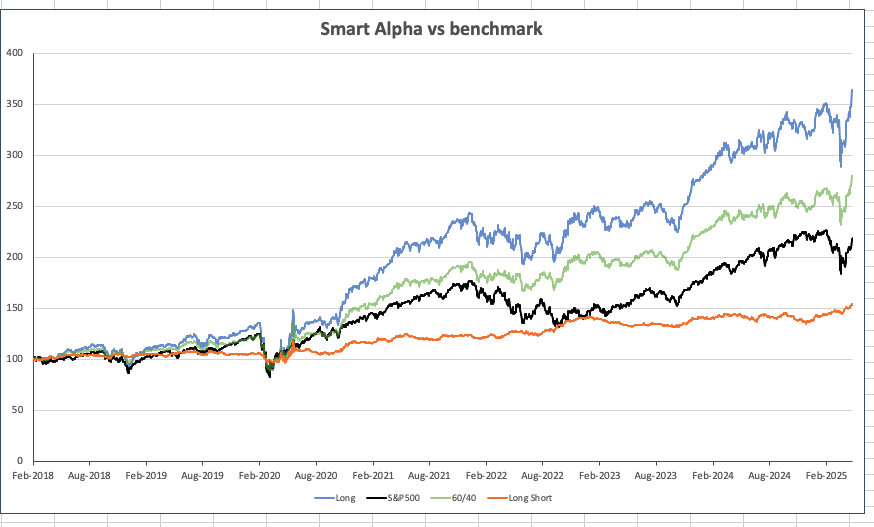

The chart below shows an example of what this fully hedged portfolio looks like from a returns perspective (orange) versus the S&P500 (black) and against a long-only Smart Alpha portfolio (blue). The 60/40 line (green) shows a portfolio that consists of 40% Orange and 60% blue portfolios.

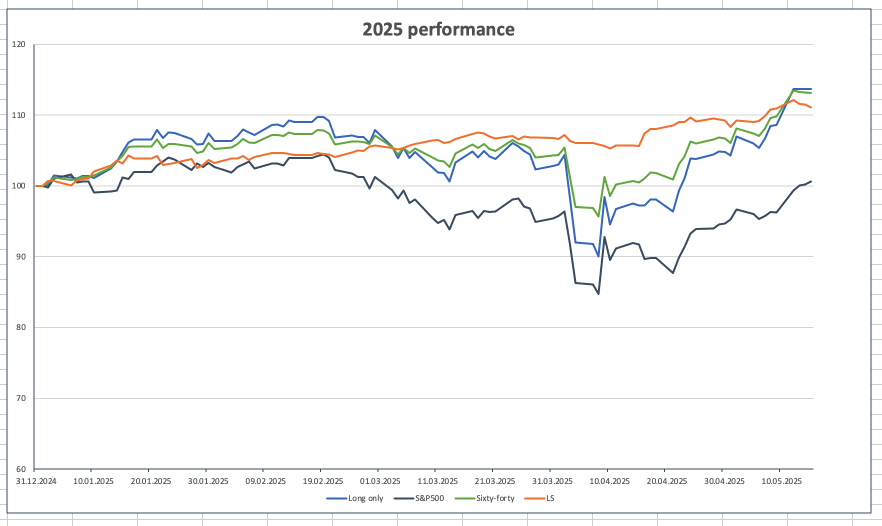

To put it into perspective against recent events, the performance of the same portfolios rebased to January 2025 is shown in Chart 2.

The Long short portfolio would certainly have helped you sleep at night with bond plus rates of return (annualised return since Feb 2018 of 6.0% with a Standard Deviation of 7%) whilst a “60/40” portfolio would have maintained a return in line with the long only portfolio (13% YTD) with lower stress. For a portfolio that allows you to gain compound returns over time (annualised return since Feb 2018 of 14.8%, Standard Deviation 15%) that significantly hedges out the market beta risk it offer a lot of advantages. It might not quite match the Smart alpha Long only rate of growth (annualised return 19.3% since Feb 2018, Standard Deviation 21%) but it’s definitely a Risk AND Reward alternative.