In the same way that many investment advisors failed to sell certain stocks when the time arose (see previous posts) they may not have the skillset or process that allows them gauge when to buy.

In markets such as this, an answer is to be found in Benjamin Graham’s Margin of safety. The principle of buying a security at a significant discount to its intrinsic value, which is thought to not only provide high-return opportunities but also minimize the downside risk of an investment. The opposite would be true in rising markets.

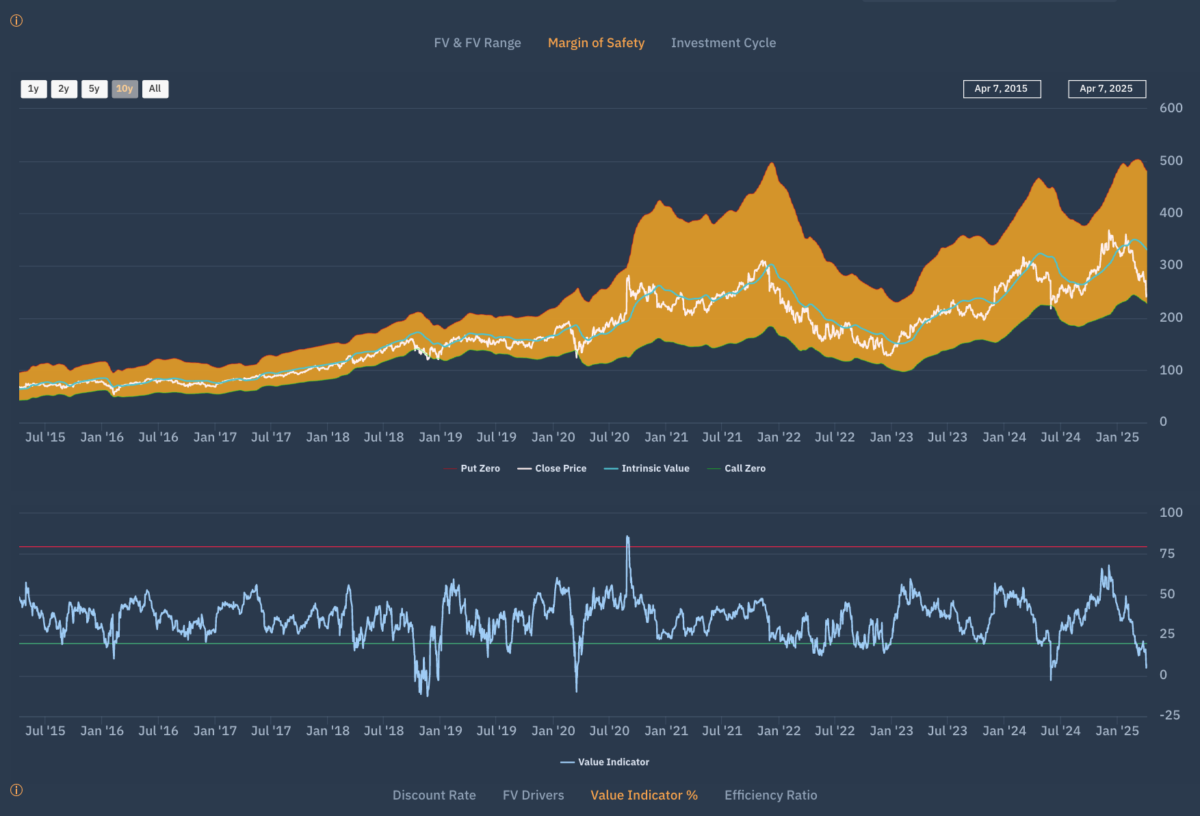

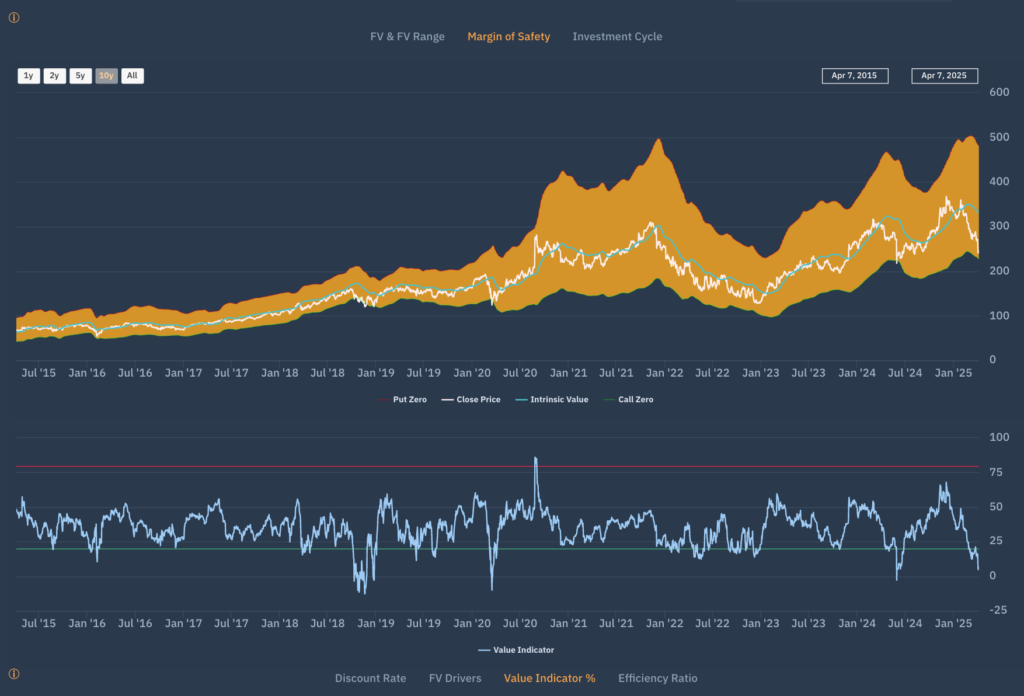

The image below represents the Apollo Margin of Safety for Salesforce. The bottom of the (orange range) represents Zero on the chart below when the risk of buying / shorting a stock is zero. The picture tells its own story (and also when it might have been an idea to sell.) The great thing about data visualisation means seeing is believing.

True story. I had a call from a client with access to the Apollo platform and he asked me to take a look the Margin of safety chart for a UK company. He’s been looking to buy. What he saw was a degree fo risk priced in equivalent to the Financial crisis of 2008/9 and Covid. All of a sudden the situation was put into perspective. I don’t know if bought or not, but he was wiser.