‘Do you feel lucky punk?’ – Dirty Harry (1972)

I have just read an article by Mark Tinker this morning that you can find here on Linkedin – ‘Fast and Slow thinking.’ To paraphrase, as markets went into a tail spin in April it was the “Fast brain” traders that sprang into action flattening trading books, selling what they could and covering short positions. Turmoil based on current events and past experiences.

By the end of the month, NASDAQ and the S&P 500 were back to where they started the month suggesting not much may have changed, but it has and after due consideration and confirmation of that change and the risks associated, “Slow brain” thinkers grind into action. These guys are the global asset allocators and the ‘Big Money’ who move slowly to unwind positions that have been built up over years once the story changes and once the tanker starts to turn it doesn’t reverse engines. They are the behemoths the Fast Brain guys want to get ahead of and not in front of.

Reporting on what has been going on and why is one thing. Knowing what to do about it and when is another altogether. For that you need to be able to visualise the change in the information and its effect upon the value of an asset – the discount rate the market is prepared to pay and attribute to future cash flows which has been the subject of previous posts both on Linkedin and our own Website (www.libra-is.com / INSIGHTS)

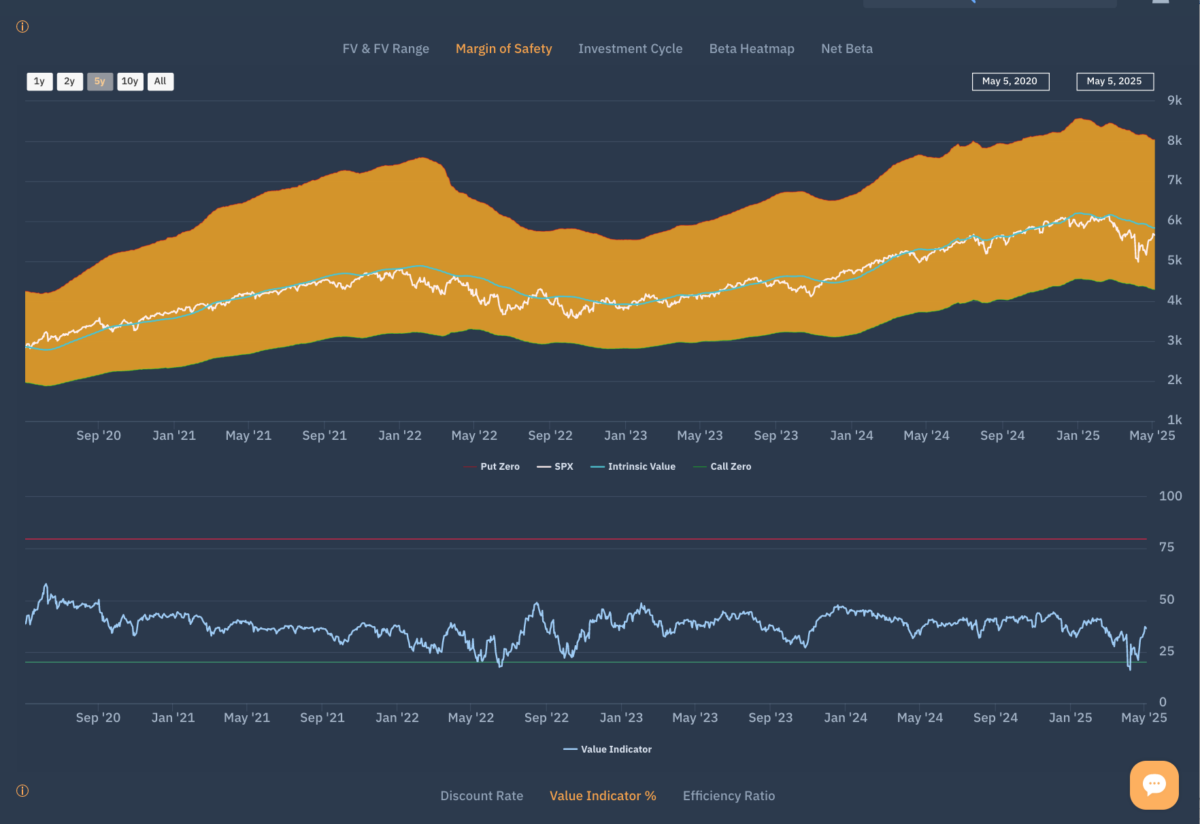

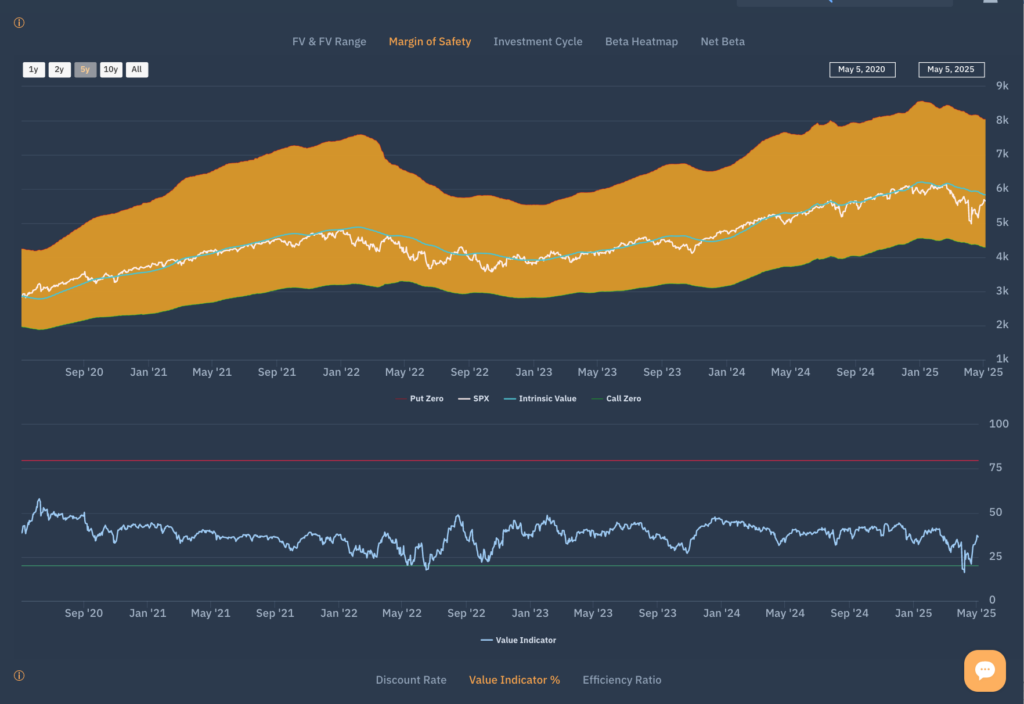

Once again, we use the Apollo Margin of Safety chart for the S&P 500 to demonstrate the impact of Fast Brain thinkers in April, but even before that the Deepseek revelation had already caused a major stir and rethink. The risk that was immediately priced in drove the market to such a discount to value that a rare opportunity to buy arose. US retail investors were mobilised with a mentality to buy the dips to such an extent that those losses have been almost erased as if nothing had happened.

That would be an incorrect assumption. For the S&P 500 the implied cost of capital and the discount rate applied to US stocks has absolutely changed and the Margin of safety chart shows, future Value has fallen from 6140 in January to 5830 as the index has rallied back to 5650 which is effectively back to a new, falling fair value. At this point the Slow Brain / longer term investors are starting to make long term, significant asset allocation decisions and that is the train you do not want to get in front of unless you are prepared to answer Dirty Harry’s question. Well do you?