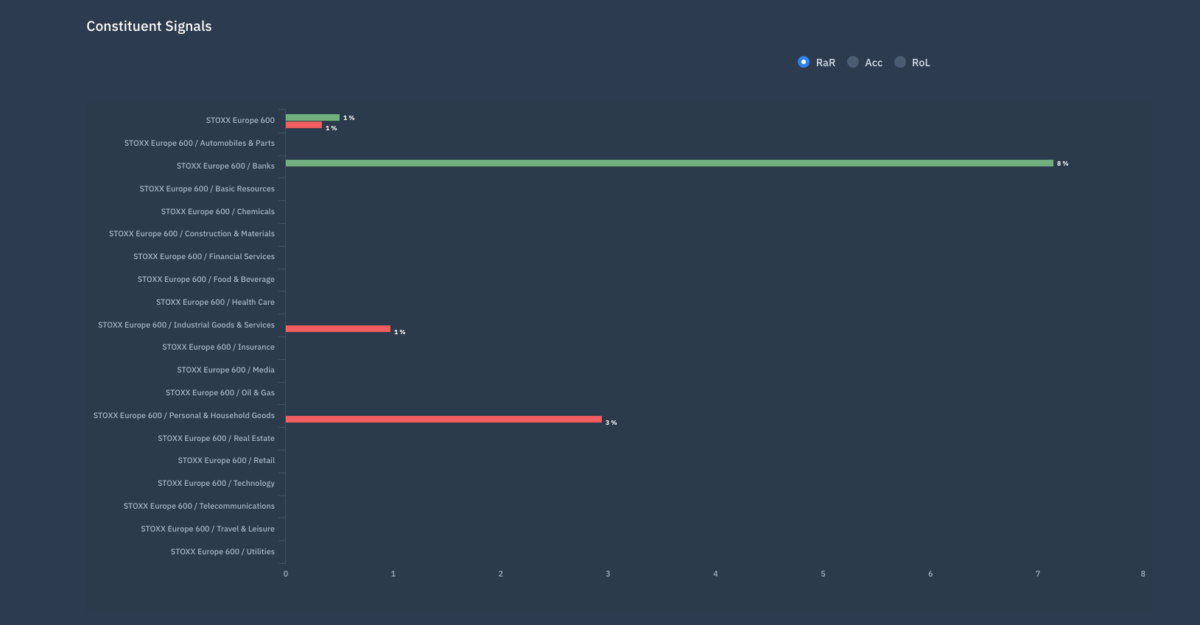

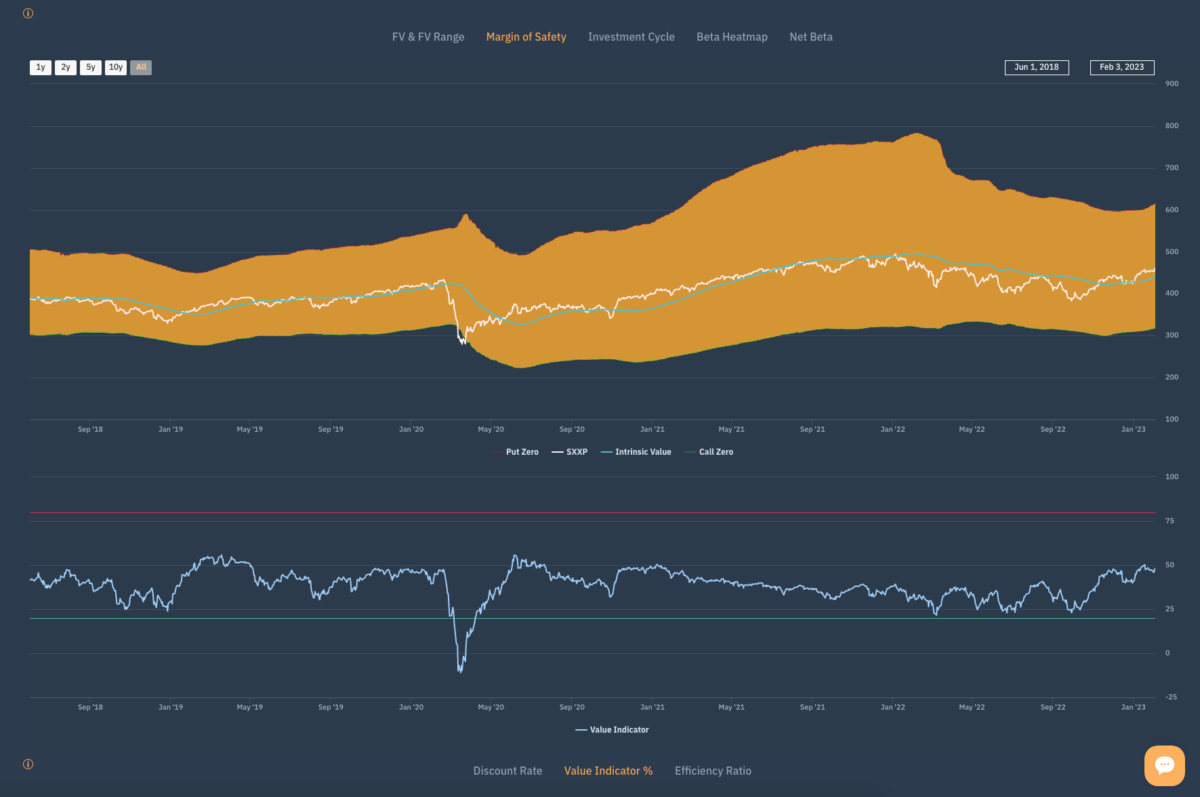

Outside of Banks the clues at a stock, sector and market level that give guidance to investors as to what to do or not do right now are few and far between. Both the S&P 500 and Stoxx 600 are no longer in the re-rating phase of the Apollo investment cycle and that points to more volatile times and as a consequence many sectors have transitioned from Re-rating to De-rating or Value

Looking for clues