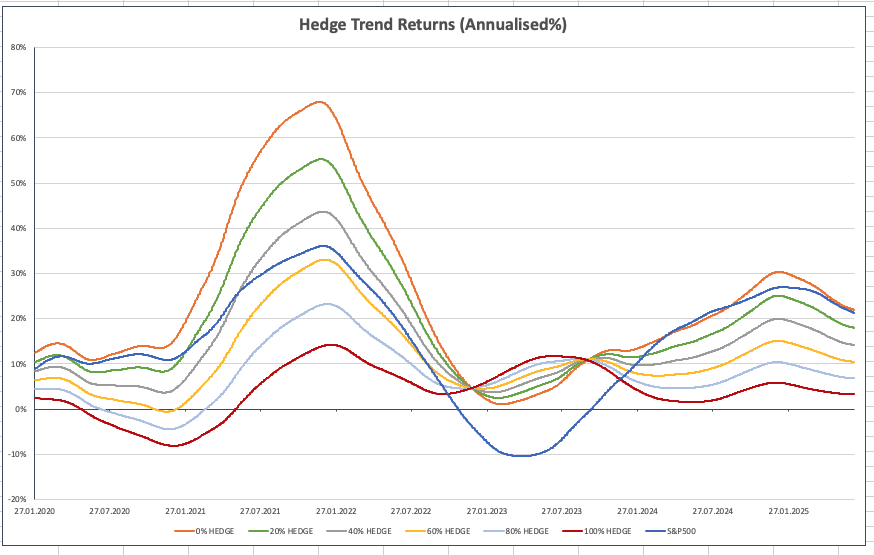

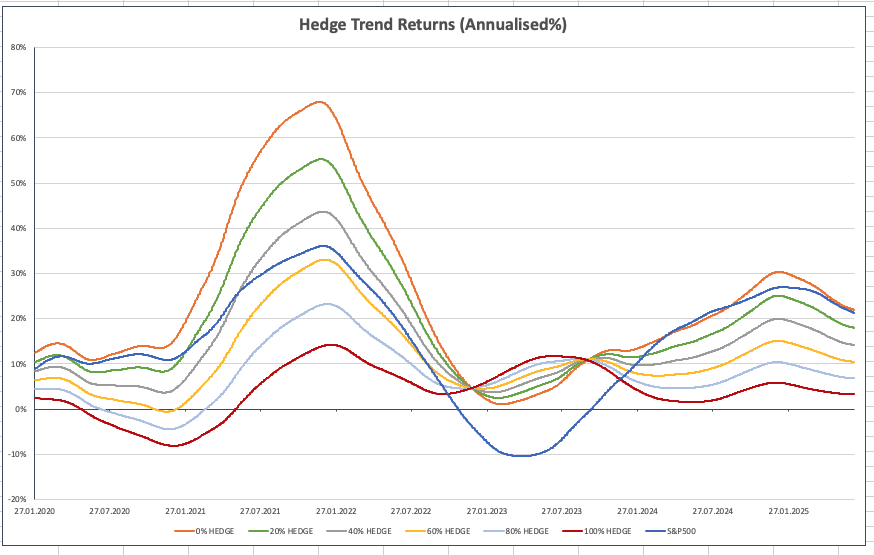

After last week’s discussion of Unknown Knowns, we update our findings and revisit the idea of how dynamically risk managing the portfolio’s exposure to underlying market risk can provide a more stable, compounding approach to investment returns.

After last week’s discussion of Unknown Knowns, we update our findings and revisit the idea of how dynamically risk managing the portfolio’s exposure to underlying market risk can provide a more stable, compounding approach to investment returns.

Investment decisions are not just about Risk and Return – they are aboutindentifying the risks you DO NOT NEED TO TAKE. A focus upon the least appreciated of the Rumsfeld identities _Unknown Knowns – helps to shape our perception of the investment biases we do not need to follow if we want to maximise wealth.

After our latest portfolio rebalances we take a look at the “Weather” ahead

Portfolio construction needs to be about both a managed process of risk and return – not about multiple risks and multiple returns

There should be a better conversation about how to manage both risk and reward in equity markets.

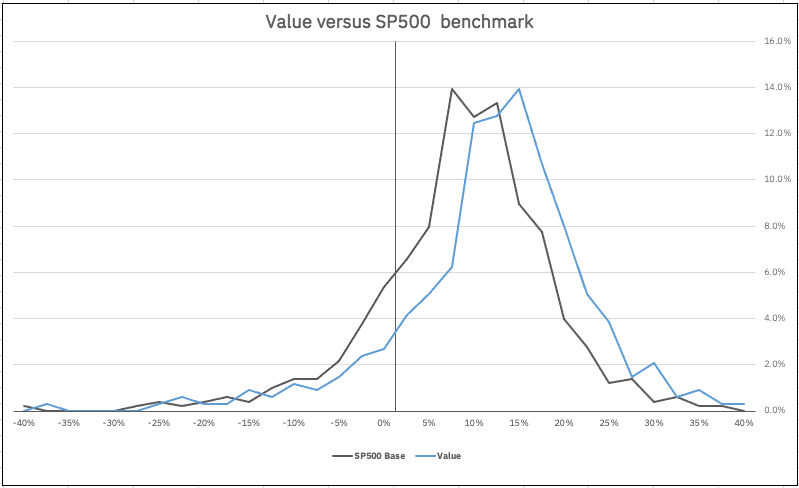

One of the most significant investment developments of recent years has been the emergence of factor-based investing as a mainstay of investment management.

As we start a new Smart Alpha “Sprint period” for out S&P500 based Strategy, it is worth reviewing how we have performed so far this year.

In Part I of the inquiry, I set out some of the structural problems that the Finance Industry is facing in the wake of the macroeconomic adjustments we experienced over the last 18 months or so and the impact that they have had on portfolio returns both in 2022 and in the future. In part II I take a closer look at the range of investment approaches – from passive to active currently being operated in the market and at the types of investment models underpinning them.

Yet again, the financial industry has had to start the year on the back foot. As lists of dramatic fund level underperformances circulate in the media, the explanations, rationalisations and justifications for failure are being delivered via fund reports and year ahead presentations.

We have recently introduced a new feature on the Apollo Edge platform that allows investors to “Smart Filter” their portfolios or watchlists at the stock level, using our proprietary investment factor groupings of Value, Re-rating, Growth or De-rating.