The team here at Libra Investment Services have been analysing global economies and markets for the best part of 40 years and, over that time have seen how the interaction of macro and micro trends, stock level financials and thematic and sector dynamics influence and, ultimately, drive the complex adaptive system that is the financial market. […]

Category: Smart Alpha

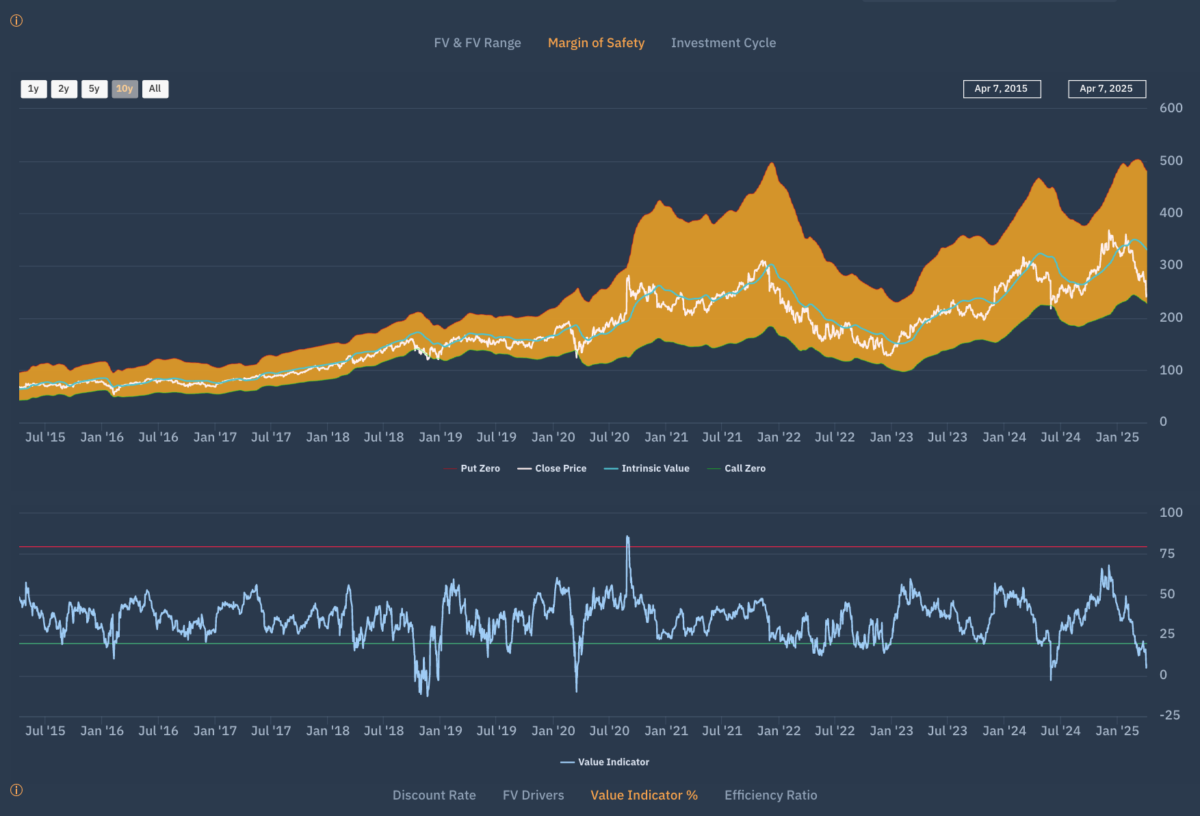

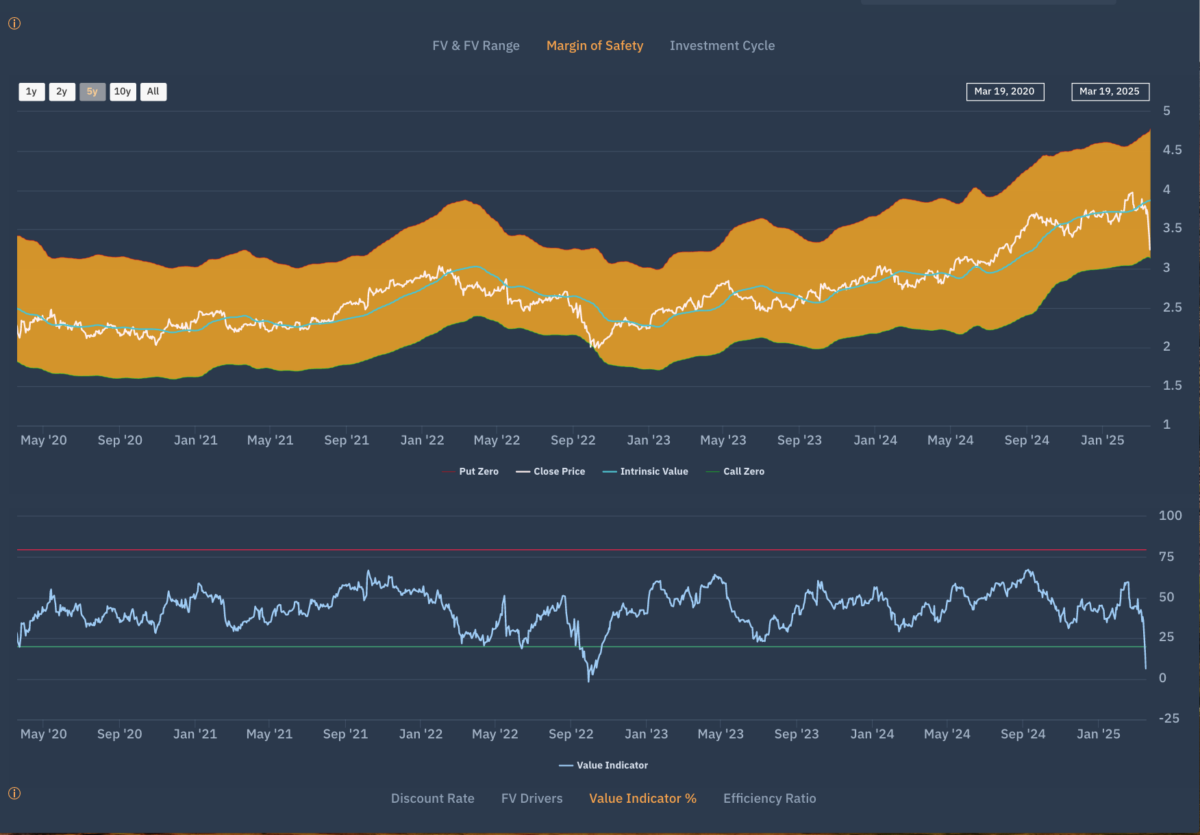

In the same way that many investment advisors failed to sell certain stocks when the time arose (see previous posts) they may not have the skillset or process that allows them gauge when to buy. In markets such as this, an answer is to be found in Benjamin Graham’s Margin of safety. The principle of […]

Fly me to the moon…

Knowing when to buy a stock is one thing but understanding the risk of loss is another skill altogether.

Euro banks are in the red

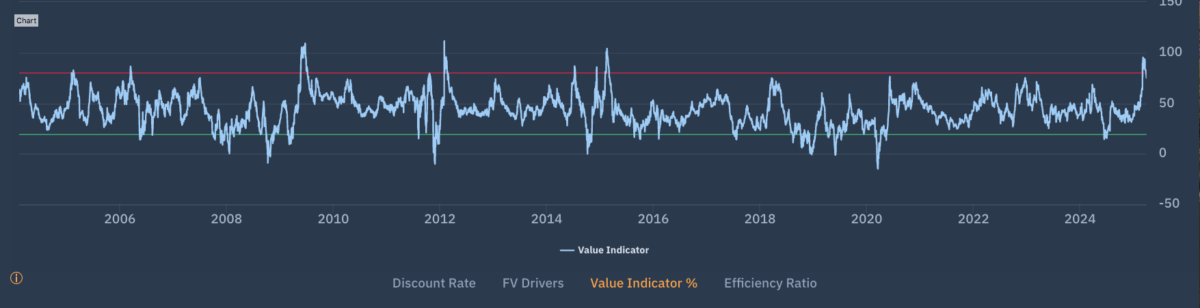

In May 2007 the sector traded at €200. During the GFC (Great Financial Crisis) the sector hit a low of €24 in March 2009 and from that moment until September 2023, the sector was an investor’s graveyard. In October 2022 Apollo deep value signals appeared equivalent to the GFC and Covid period. A Need to […]

As someone who has been around long enough to be following Tesco’s stock market journey since the late 1980’s I found myself bemused by the share price reaction to the news that Asda was on the verge of announcing a price war. Over the years we have got used to price wars, particularly the threat […]

Investors thought they had entered the year with complete clarity. US exceptionalism being just one of those factors. Last years winners would be this year’s winners etc. Sure, there would be change under Donald Trump’s presidency but no-one forecast what has happened and would happen and for investors, to use an excellent analogy the cockpit […]

A series of individual stock concerns in both the US and Europe – think Glaxo Smith Kline, Moderna, Astra Zeneca, Eli Lilly, Smith and Nephew, Merck and even Novo Norsdisk added to the fact that the new Trump administration may not be friendly for the sector has seen the sector in a Trump Slump.

Investing is all about knowledge which is why we have always used the phrase “The Need to Know” when describing what Apollo is and does and h0w it can help investors. Apollo (through the EDGE platform) provides investors an insight which gives them that edge.

Backing the winners

As regular readers know, we like a sports analogy and so let’s think about horse racing for a moment. As a person who goes racing twice a a year for a good day out, I don’t follow racing like I follow other sports. I don’t research the race card before attending and yet I place […]

Factor facts

One of the most significant investment developments of recent years has been the emergence of factor-based investing as a mainstay of investment management.