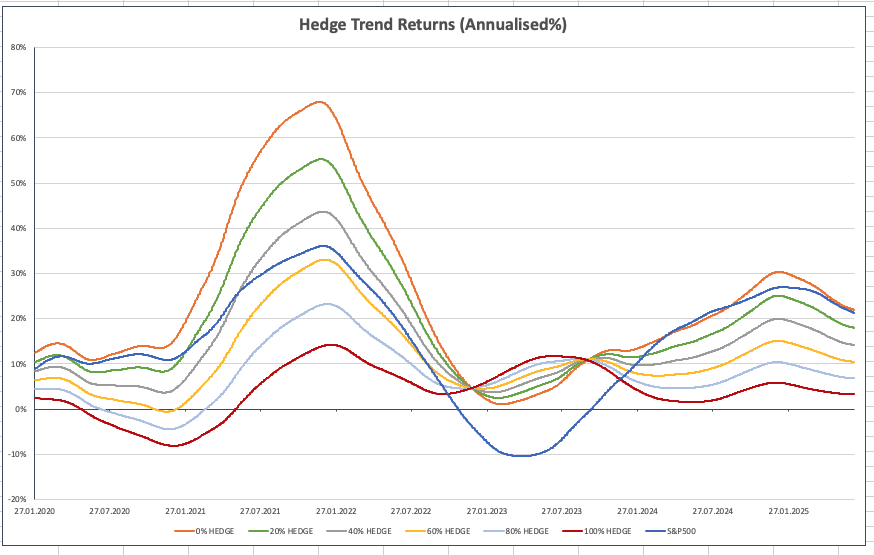

This month’s weather report is more of a weather alert as markets enter a “Chaos phase”. What we can see is where we have entered the current period of market turbulence from – those are our initial starting conditions. As for the outlook ahead? We have no visibility right now but we must go forward anyway…