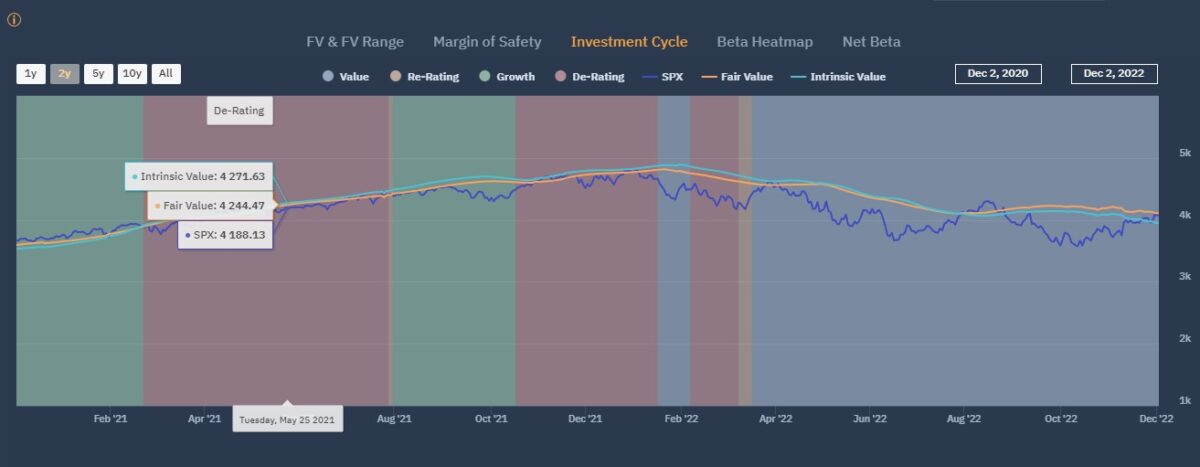

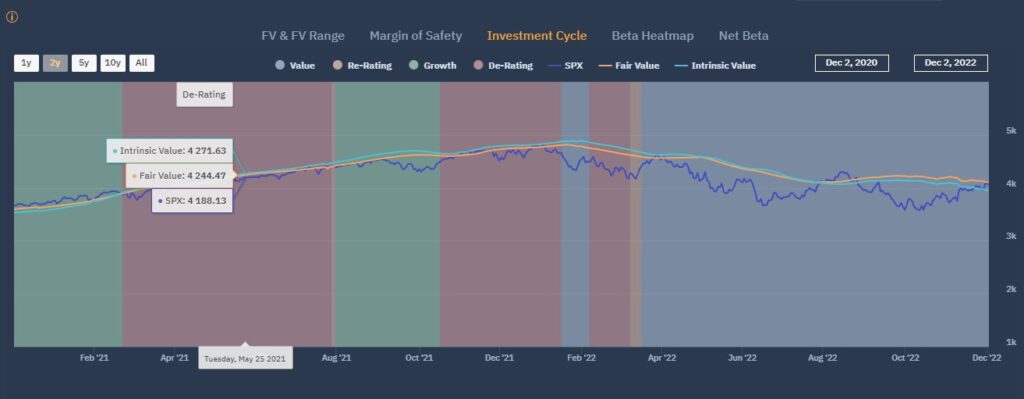

Today we introduce the Apollo Investment Cycle on the EDGE platform. Clients will already be aware that they can Smart Filter their portfolios and watchlists at a stock level using the proprietary investment factor groupings of Value, Re-rating, Growth and De-rating.

This introduction is actually a ‘coming out’ because we have been beta testing for sometime and actually wrote an article on this very Blog on October 26 – “From 0.4% to 4.0% – the derating of the S&P500” and showed how the Apollo signals could help gauge the market which at the time was down 19% for for the year in response to Fed tightening.

The question posed at the time was “has the market corrected far enough in price and value to attract investors?” and using Apollo’s market level signals and analytics – the expected return forecast, the Implied Cost of Capital and the level of uncertainty in the price we showed that it had – by mid March the S&P was in Value territory.

Armed with where we were in the Investment Cycle, it was a question of understanding the expected return using Apollo’s Risk Adjusted Return indicator and here we found that due to a 12% deterioration in FV and the 12 month target price the S&P 500 was discounting the lower boundary of our probability of returns – 3934-5534 when the index was trading at 3859 at which point the future expected return (FV) was no longer falling – QED it wouldn’t take much to see a market reversal and so it turned out…